How Citibank Comes even close to Most other Unsecured loan Businesses

Citi also provides multiple choices for managing the loan membership. You could potentially song your percentage background otherwise build money thru Citi’s cellular application, by the mobile phone, otherwise by the logging into your Citi membership on the internet.

Citibank also provides a competitive Apr diversity and flexible payment terms since in contrast to most other consumer loan people. And the same as almost every other lenders, Citibank allows individuals to use its personal loans for almost any financing goal.

However, Citibank falls quick with respect to the maximum financing quantity provided. However some banking institutions make it licensed applicants so you can borrow around $one hundred,100, Citibank merely makes you use to $30,000 after you pertain on the web.

Citibank compared to. Wells Fargo

Wells Fargo, a giant standard bank that is comparable to Citibank, now offers signature loans. Like Citibank, it’s got personal loans and no prepayment penalty otherwise origination fees. But not, there are many trick variations:

- Wells Fargo offers big mortgage wide variety than simply Citibank-up to $a hundred,one hundred thousand having qualified individuals.

- Wells Fargo’s lowest-stop Apr-5.74% with a love write off-is even below Citibank’s.

- As well as, the newest longest unsecured loan term having an effective Wells Fargo personal loan is seven ages.

Citibank also offers personal loans to consumers with qualified Citi deposit levels. People can also be secure rewards situations getting hooking up their financing accounts to the deposit account, additionally the Citi cellular software also offers a handy solution to carry out and you can song financing costs. Their mortgage terms are flexible, ranging from as the short overall 12 months so you’re able to as long as five years.

While borrowers having sophisticated borrowing from the bank might find all the way down minimum interest levels at the other significant financial institutions, Citibank’s minimum rates away from seven.99% is still competitive. Together with undeniable fact that it’s got unsecured loans with no origination and prepayment charges tends to make it a nice-looking personal bank loan selection for current Citibank customers.

Although not, before you apply for a great Citibank personal bank loan, you will need to think about the drawbacks. Citibank possess reasonable critiques towards Trustpilot, cannot offer an effective pre-certification solution, and contains much slower resource minutes than additional loan providers. Incase you intend for the beginning a qualified Citi membership so you’re able to remove a personal bank loan, you are going to need to waiting no less than three months, that’s a major disadvantage if you like finance quickly.

Strategy

Investopedia was dedicated to providing consumers with unbiased, comprehensive ratings regarding personal loan loan providers. In order to rates organization, we collected more twenty-five investigation items all over over 50 lenders, also rates of interest, costs, financing wide variety, and you may repayment terms and conditions with the intention that all of our studies assist users generate advised decisions for their credit demands.

Specific borrowers are hesitant because of potentially mediocre costs and you can terrible buyers critiques, but anyone else, such as for instance primary consumers that already Citibank consumers, will find a great Citi unsecured loan suits the balance.

Of several or all companies checked render settlement to help you LendEDU. These types of commissions was how we take care of all of our totally free services for consumerspensation, plus times out-of within the-breadth editorial research, establishes where & just how companies appear on the web site.

With more than 2 hundred years of feel, Citibank has experienced for you personally to nurture a flourishing monetary providers, and today, that have a loan collection consisting of billions of cash, the firm takes on a life threatening part from inside the fulfilling the private financial requires regarding customers across the globe.

With like a significant visibility on financial and you will credit card market, chances are high you have discover a great Citi equipment on certain area, but with unnecessary most other loan affairs offered, is a Citibank personal bank loan most effective for you?

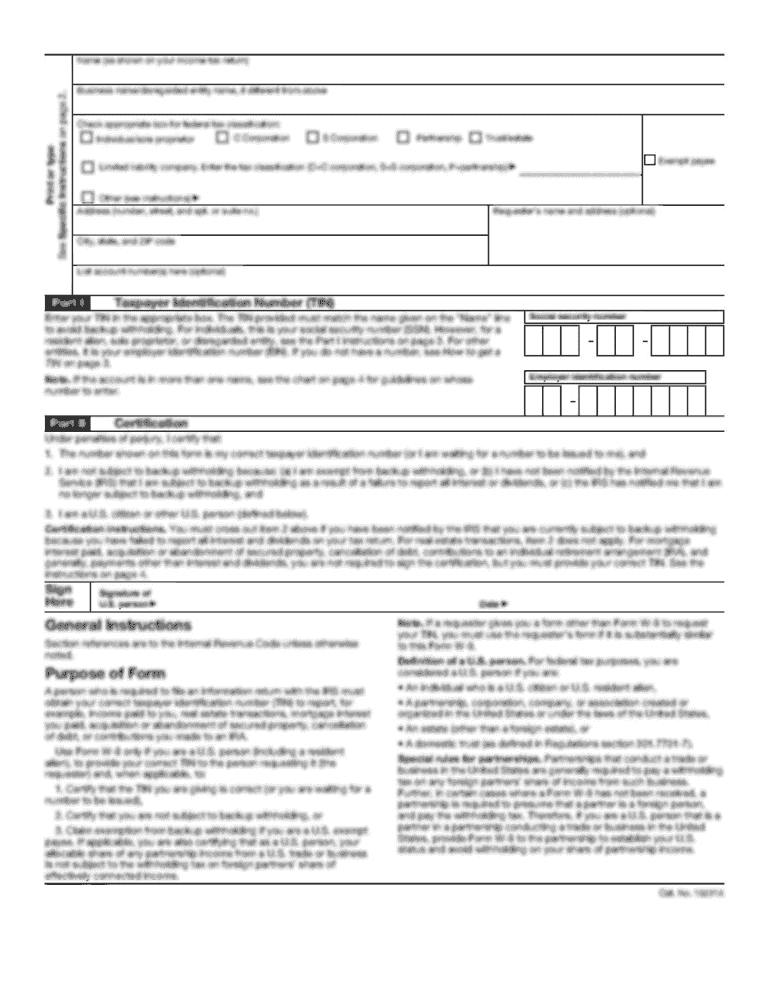

Making an application for good Citibank Unsecured loan

Citibank provides 3 ways to have borrowers to apply for money: on the internet, over the telephone, or in the a district  branch. While borrowers may use those methods to submit an application for that loan around $31,100000 , individuals who would like to borrow increased amount borrowed need to implement by the cellular telephone or by visiting their local department.

branch. While borrowers may use those methods to submit an application for that loan around $31,100000 , individuals who would like to borrow increased amount borrowed need to implement by the cellular telephone or by visiting their local department.